WHEN Bryan Robson was the elder statesman of the Manchester United squad in the early 1990s, Sir Alex Ferguson set him a task with the Class of ’92.

The England legend was asked by the iconic boss to help the incredible youngsters coming through at Old Trafford with their financial matters.

He told SunSport: “Sir Alex always wanted to protect the Class of ’92 when they were coming through.

“On occasions, he would pull me in his office and just say, ‘I can’t keep up with all these young lads. Try and give them good advice, because they may be getting new contracts with the club’.

“The boss didn’t want them tying themselves up with agents who were going to take big fees.

“I went in and negotiated for a few of the boys, which they were really happy with.”

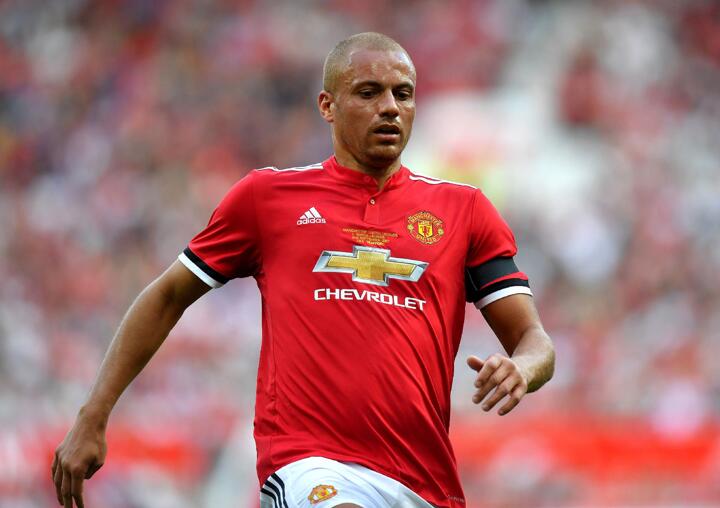

Fast forward 30-plus years, Robson, now 67, is embarking on a new business venture that could be crucial in today’s world, and echoes back to that experience.

He has co-founded High-Performance Individuals alongside former Manchester United apprentice Simon Andrews – with the aim to give high earning sports, media, music and entertainment stars financial and investment advice.

In recent times, footballers Wes Brown and Chris Smalling have spoken about being badly advised with their money.

While TV personality Katie Price is bankrupt again, after reportedly blowing a £45million fortune.

Robson admitted it’s heartbreaking seeing former teammates suffering, which prompted him and friend Andrews into action.

He explained: “Simon Andrews, who was in the financial world and a former apprentice at Manchester United, approached me with the idea.

“You get fed up of seeing teammates going bankrupt or losing a lot of money in investments.

“I just thought someone’s got to do something about it because it’s just not right that the education system doesn’t get to some of the lads.

“That’s why we have set this company up. We don’t want to be an agent. All we want to do is do reports for people who are in financial difficulties or people who might just want a report to see if everything’s in place.

“We have professional people in every walk of the financial system, so really it’s like a financial plan.

“We aren’t telling them what they have got to do. It’s up to the individual person what they want in life, and whether they want to invest in anything.

“And it’s also about educating people about knowing about tax, are they getting the right mortgage, or the right lease for their car – all these sort of things we want to cover.”

HPL won’t take commission, nor will they take money from their clients in the future.

They provide a report, work alongside agents or mum’s and dad’s of the talent, depending on who works as the advisor.

“They have to be educated as well to make sure they are doing the right thing for the individual,” Robson added.

Alongside his incredible football career, Captain Marvel launched several business interests.

He scored success with greeting cards, but lost money investing in schemes which aimed to take advantage of tax breaks for film productions.

Today he manages various properties with his wife, Denise.

He continued: “When I got into the England team, then I signed for Manchester United everybody wants to chat to you.

“Everybody is a millionaire and tells you this is how they made their money… you’ve got to be wary of that person.

“I’m not saying I was perfect. I came from a council estate, went to a decent school, my mum and dad were good parents, but I lost money on the film schemes, like many other footballers did in the 1980s and 1990s.

“My advice is, if you are going to invest in something make sure you can afford to. If it goes pear-shaped, you’re not then missing that money and it’s not affecting your life.

“I was lucky with another business which I went into with my best mate for greeting cards when I was with Manchester United.

“What it did was take me away from other things, I just wanted to concentrate on the business doing really well. Fortunately for me it was successful.

“The pitfalls were definitely there when I was playing, the players have just got to be aware of that.”

Explaining how the reports work, Robson admitted “trust” was a key part of the process.

“All we want to do is try to help and advise, what to stay away from, what is a good investment,” he told us.

“When we do this report, we ask the individuals if they want to stay in football, if they want to be a coach or work in the media world.

“It’s really just a matter of finding out what the individual wants to achieve when they wrap up their playing days.

“Even in my days there was a lot of players that went bankrupt, and their financial situation caused divorce. You just don’t want to see that, and if you can help them that’s what myself and the company want to do.”

But, despite many suffering with financial woes, plenty are also switched on when it comes to their finances.

Robson explained: “Recently, we did a report for one player who was very honest with us and told us everything about his family and what he’s got in place.

“To be fair, we went away, we spoke about it, and there wasn’t really anything we could do.

“We told the player, ‘you’ve done really well, you’ve got everything in place and it looks good.’

“He said, ‘this is fantastic, all players should have this because it’s like an audit.

“They might have something wrong, but it’s great to hear everything is in place too.”